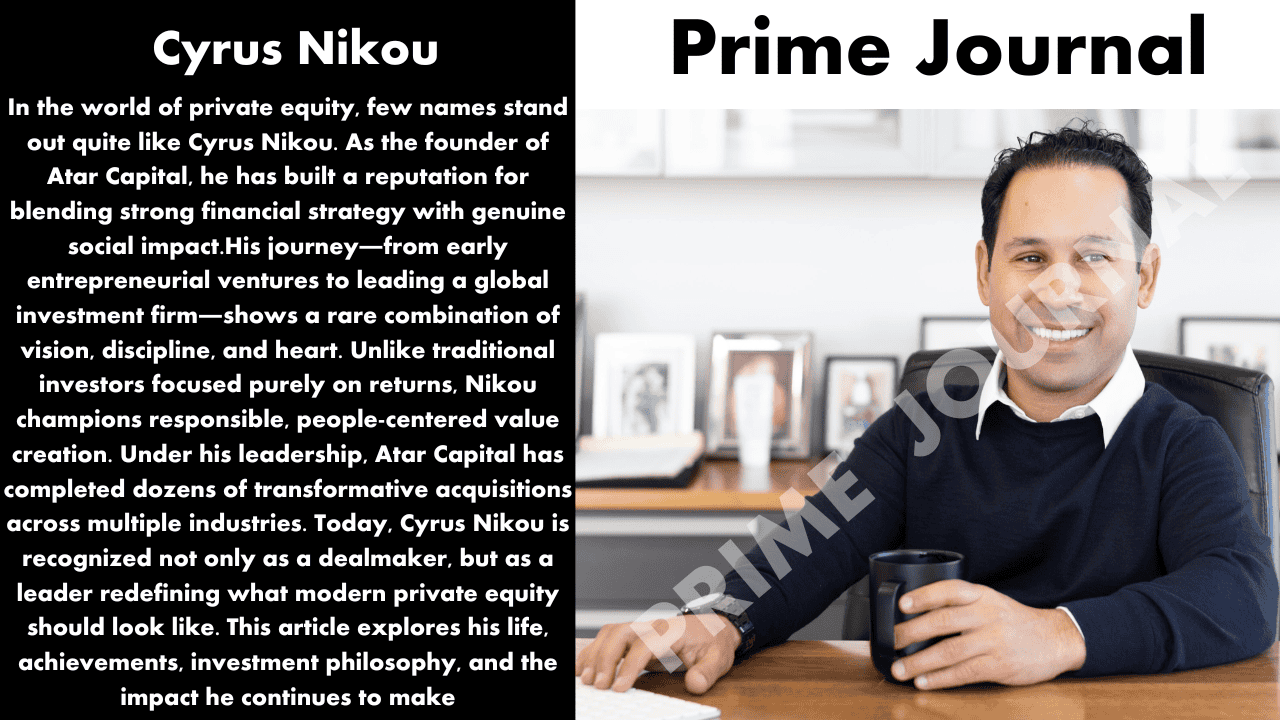

Cyrus Nikou is a name that’s become increasingly prominent in the world of private equity, socially responsible investing, and deals that combine financial returns with meaningful impact. As the founder and managing partner of Atar Capital, Nikou has built a firm that not only seeks strong financial performance but also strives to drive positive social and environmental change.

In this article, we’ll explore Cyrus Nikou’s background, his investment philosophy, key achievements, and why he stands out in the private equity landscape today.

Table of Contents

- Early Life & Education

- Career Beginnings

- Founding Atar Capital

- Atar Capital’s Investment Philosophy

- Notable Portfolio Companies and Deals

- Philanthropy & Social Impact

- Recognition & Awards

- Leadership Style & Personal Values

- Challenges & Lessons Learned

- Cyrus Nikou’s Vision for the Future

- FAQs

- Conclusion

Early Life & Education

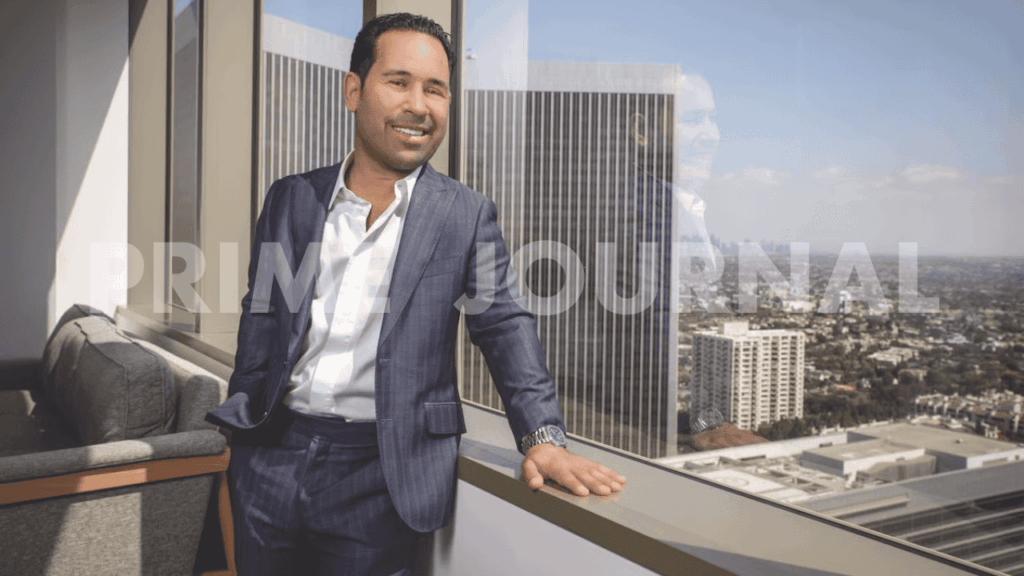

Cyrus Nikou was born in Vancouver, Canada, and later moved to Los Angeles, California.Growing up in a dynamic environment, he developed an early interest in business and finance.

He went on to earn a Bachelor of Science in Business Administration and Corporate Finance from the University of Southern California (USC), Marshall School of Business. His education provided a strong foundation in financial theory, deal structuring, and business operations, all of which would later become critical in his career in private equity.

Career Beginnings

Before founding Atar Capital, Cyrus Nikou built a diverse and solid career in finance and entrepreneurship:

- He co-founded Revolution Capital Group, an L.A.-based private equity firm.

- He also founded Funded Capital, a mortgage bank, giving him exposure to real estate finance and lending.

- His previous roles included managing capital commitments, overseeing operations, and leading deal origination teams.

These early experiences shaped his understanding of how to grow—and turn around—underperforming businesses.

Founding Atar Capital

In 2016, Cyrus Nikou launched Atar Capital, a lower-middle-market private investment firm headquartered in Los Angeles. Under his leadership, Atar Capital has grown into a global firm with a strong footprint across various industries.

Nikou wears many hats at Atar: he oversees mergers & acquisitions, corporate development, operations, and the firm’s overall strategic direction. As founder and managing partner, he has been instrumental in building Atar’s culture, infrastructure, and investment philosophy.

Atar Capital’s Investment Philosophy

One of the things that sets Cyrus Nikou and Atar Capital apart is their dual focus: financial value creation and positive social impact.

Key pillars of their philosophy include:

- Sustainable and socially responsible investing: Atar deliberately looks for companies that contribute positively to their communities or environment. i

- Operational partnership: Rather than just providing capital, Atar works closely with portfolio companies to improve operations, scale sustainably, and deliver long-term growth.

- Human-centered value: Nikou often emphasizes that investing is not just about balance sheets; it’s about people—the entrepreneurs, employees, and communities connected to the businesses.

- Responsiveness and adaptability: Atar’s team is designed to be nimble—able to pivot, respond quickly, and support companies through change.

Notable Portfolio Companies and Deals

Under Cyrus Nikou’s leadership, Atar Capital has made several significant acquisitions and built a diverse portfolio:

- WinCup Corporation: A leading manufacturer of food-service products, including biodegradable and sustainable utensils, cups, lids, and straws.

- Pathways Health & Community Support: A provider of behavioral health and community services.

- Keypoint Intelligence: A data, research, and consulting firm.

- Frontier Integrity Services and Microcel Corporation, among others.

Some deal highlights:

- Since its founding, Atar has executed more than 20 acquisitions (per interviews)

- The firm manages a global portfolio spanning more than a dozen companies, generating over US$1.5 billion in combined revenue and employing 13,000+ people.

- Atar has completed 90+ private equity transactions across 18 countries.

These figures showcase Nikou’s ability to scale an investment firm with both financial acumen and operational mastery.

Philanthropy & Social Impact

Beyond his role as a dealmaker, Cyrus Nikou is deeply committed to giving back and contributing to his community. His philanthropic ethos is integral to his personal brand and his firm’s identity.

Some of the key social impact initiatives and commitments:

- Board Memberships & Non-Profits: He serves on several boards, including the Sierra Canyon School, a college preparatory day and boarding school.

- Charitable Support: Nikou supports multiple Los Angeles–based charities such as the I Have a Dream Foundation – Los Angeles, Los Angeles Children’s Hospital, Upward Bound House, and the Los Angeles Mission.

- Sustainable Products: His investment in WinCup aligns with environmental sustainability—producing biodegradable and compostable products.

- Award-Winning recognition for impact: In 2024, Nikou received the Thomas Farrell Memorial Award for his leadership in M&A and his commitment to community-driven investments.

Recognition & Awards

Cyrus Nikou’s leadership has not gone unnoticed. Some of his key recognitions:

| Award / Honor | What It Represents |

|---|---|

| Thomas Farrell Memorial Award (2024) | A prestigious award celebrating exceptional contribution to the M&A industry. |

| Induction into the M&A Advisor Hall of Fame (2024) | Significant recognition for his impact, vision, and long-term excellence in dealmaking. |

| “Leaders of Influence: Private Equity & Investors” by LA Business Journal | Highlighting his influence in the lower-middle-market investing space. |

These awards underscore Nikou’s credibility, authority, and respect in the investment community.

Leadership Style & Personal Values

Cyrus Nikou’s leadership style is shaped by his vision, humility, and people-centric approach. Key aspects include:

- Empathy & Human Capital Focus

He believes that the true value in investing comes not just from assets, but from the people behind those assets: founders, employees, and communities. - Operational Involvement

Rather than being a silent financial backer, Nikou engages deeply with portfolio companies, helping them grow operations, optimize systems, and scale responsibly. - Long-Term Vision

His investments reflect a commitment to sustainability—not only in environmental terms but also in business models that can serve future generations. - Resilience & Adaptability

In the unpredictable world of private equity, Nikou emphasizes adaptability. He has noted that “there isn’t a typical day”—and success often comes from being agile. - Giving Back

His philanthropic work and board involvements align with a strong moral compass. He channels his success into improving his community, especially in education and mental health.

Challenges & Lessons Learned

No journey is without its hurdles. Over the years, Cyrus Nikou has faced challenges—and learned important lessons:

- Risk Management: In interviews, Nikou has admitted to having made mistakes by moving too fast or oversimplifying due diligence. From that, he learned the importance of deep, rigorous evaluation rather than shortcuts.

- Balancing Growth & Impact: Striking the right balance between social mission and profitability is tricky. Nikou has refined Atar’s strategy to ensure investments deliver both measurable impact and financial returns.

- Maintaining Team Culture: Scaling a values-driven firm means preserving culture even as the team grows and spreads globally. For Nikou, leadership by example has been central to keeping Atar grounded.

- Unpredictable Markets: As private equity markets fluctuate, Nikou underscores flexibility and tenacity. He encourages a mindset of long-term commitment—and readiness to pivot when needed.

Cyrus Nikou’s Vision for the Future

Looking ahead, Cyrus Nikou appears focused on several core ambitions:

- Scaling Socially Responsible Investments

He aims to increase Atar’s pipeline of deals in sectors that produce tangible environmental and social benefits—healthcare, sustainable consumer goods, and services. - Global Expansion

With Atar already having a global footprint, Nikou is likely to deepen its presence in emerging markets, supporting companies that can both grow and contribute positively to their communities. - Building an Ecosystem

He envisions Atar not just as an investment firm but as a platform that nurtures leaders: helping portfolio company executives develop, building networks, and sharing best practices. - Education & Community Engagement

Through board work and philanthropy, Nikou plans to continue investing in future generations—especially by supporting schools, non-profits, and initiatives that uplift underserved communities. - Innovation through Sustainability

Nikola is passionate about innovations that address global challenges—such as climate change, mental health, and resource scarcity. He believes that investing in sustainable technology is not just good ethics, but strong economics.

FAQs

Here are some common questions about Cyrus Nikou, along with detailed answers.

1. Who is Cyrus Nikou?

Answer: Cyrus Nikou is a serial entrepreneur, investor, and philanthropist. He is best known as the founder and managing partner of Atar Capital, a private equity firm focused on lower-middle-market companies and socially responsible investing.

2. What is Atar Capital?

Answer: Atar Capital is a private investment firm launched by Cyrus Nikou in 2016. The firm specializes in acquiring and scaling underperforming or complex lower-middle-market businesses, leveraging operational expertise and sustainable value creation.

3. What makes Atar Capital different from other private equity firms?

Answer: Atar Capital prioritizes sustainability, social impact, and human-centered value. Unlike purely financially driven firms, Atar deeply engages with its portfolio companies operationally and seeks to generate positive community and environmental outcomes.

4. What are some notable companies in Atar’s portfolio?

Answer: Some of the most notable include:

- WinCup Corporation: maker of biodegradable food-service products.

- Pathways Health & Community Support: behavioral health services provider.

- Keypoint Intelligence: consulting and information firm.

5. What recognitions has Cyrus Nikou received?

Answer: In 2024, he was honored with the Thomas Farrell Memorial Award and inducted into the M&A Advisor Hall of Fame, acknowledging his leadership and impact in the M&A and private equity space.

6. What is Cyrus Nikou’s educational background?

Answer: He earned a Bachelor of Science in Business Administration and Corporate Finance from USC’s Marshall School of Business.

7. How does he give back?

Answer: Nikou is involved in a variety of philanthropic efforts. He serves on the board of Sierra Canyon School, supports the I Have a Dream Foundation, Upward Bound House, Los Angeles Children’s Hospital, among others.

8. What lessons has he learned in his career?

Answer: Some key lessons include:

- Do not rush diligence — rigorous evaluation matters.

- Blend impact with business — seeking both returns and social/environmental good.

- Scale with values — retaining a values-driven culture is vital for long-term success.

- Stay flexible — market conditions change, and adaptability is crucial.

Conclusion

Cyrus Nikou stands as a compelling example of how private equity can be a force for good. By combining deal-making prowess with a deep sense of social responsibility, he has built Atar Capital into more than just an investment firm—it’s a vehicle for lasting, positive change.

- His entrepreneurial journey shows that financial success and social impact are not mutually exclusive.

- His leadership style reflects empathy, humility, and a long-term vision.

- His legacy is not just measured in revenue, but in the lives his investments touch and the communities he supports.

If you’re interested in learning more about Cyrus Nikou, Atar Capital, or socially responsible investing in the lower-middle market, stay tuned for more deep dives and profiles.

- For entrepreneurs: Consider how your business could align with impact-driven investors.

- For job seekers: Explore career opportunities at Atar Capital or its portfolio companies.

- For investors: Reflect on how ESG (environmental, social, governance) principles might fit into your own strategy.