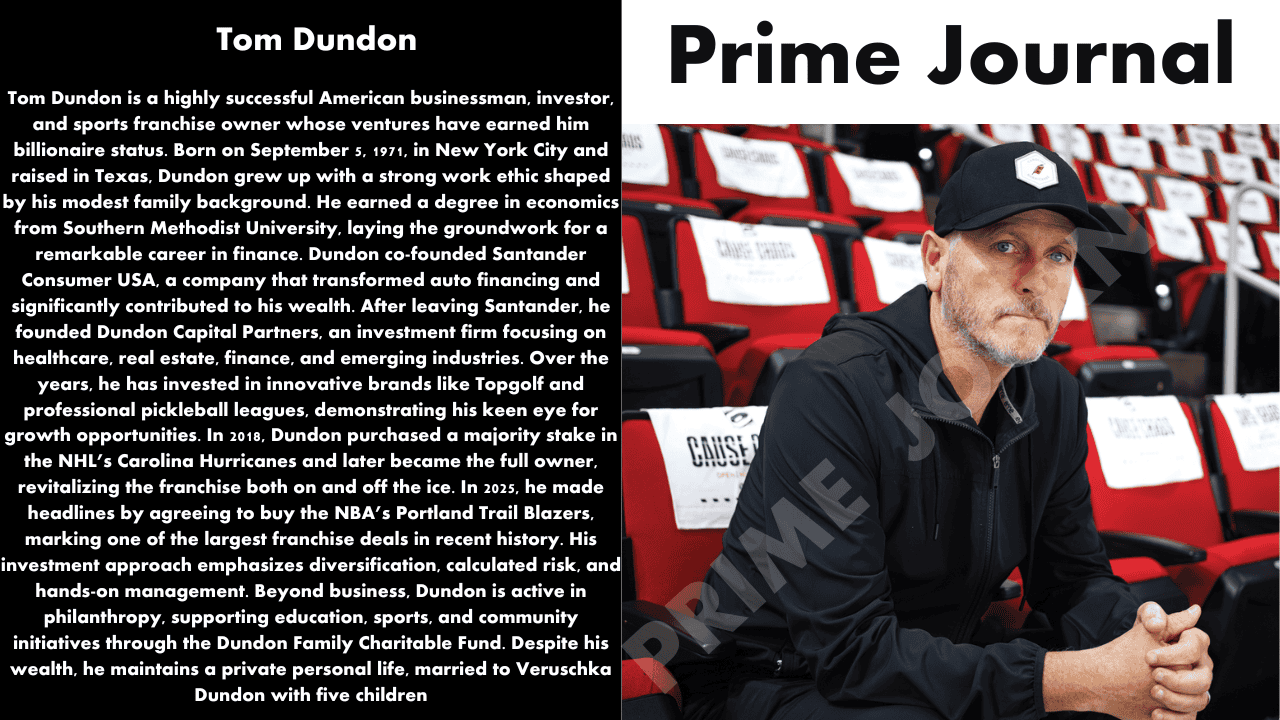

When it comes to influential figures in business and sports ownership, Tom Dundon stands out as a powerful self‑made entrepreneur. From building financial empires to owning major professional sports franchises, Dundon’s journey offers fascinating insight into how wealth is created, managed, and expanded in today’s dynamic economy.

In this comprehensive guide, we explore Tom Dundon net worth (2026 estimates), his career evolution, investment philosophy, business portfolio, and how he made a name for himself in multiple industries. We’ll also answer the most frequently asked questions about his wealth, life, and ventures.

Who Is Tom Dundon?

Tom Dundon (full name Thomas G. Dundon) is an American billionaire businessman and investor known for his leadership in finance, real estate, and sports franchises. He is:

- Chairman and Managing Partner at Dundon Capital Partners in Dallas, Texas

- Owner and Governor of the Carolina Hurricanes (NHL)

- Part of the ownership group acquiring the Portland Trail Blazers (NBA) in 2025

- Investor in entertainment brands like Topgolf and professional pickleball leagues

Tom’s story goes beyond numbers — it’s one of resilience, smart investments, and strategic diversification into some of the most exciting economic sectors today.

Early Life and Education

| Attribute | Details |

|---|---|

| Full Name | Thomas G. Dundon |

| Date of Birth | September 5, 1971 |

| Birthplace | New York City, USA |

| Raised in | Texas (Plano, Houston, Atco) |

| Education | B.S. in Economics, Southern Methodist University (SMU), 1993 |

Tom’s upbringing wasn’t affluent. His family background included a mother who worked as an electrician and a father in sales. Growing up with modest means instilled in him a strong work ethic and entrepreneurial mindset.

While at SMU, he was president of his fraternity — a role that marked the early signs of his leadership and ambition.

Career Beginnings: From Finance to Entrepreneurship

Tom’s career began in automobile financing — not at the top but on the showroom floor. Here’s a snapshot:

- 1990s: Worked at a used car dealership in finance and lending.

- 1997: Co‑founded Drive Financial Services, which would later become Santander Consumer USA.

Under Dundon’s leadership, Santander Consumer USA grew rapidly, acquiring billions in assets and eventually going public. This early success laid the foundation for his future wealth.

In 2015, Tom stepped away from Santander and launched his own investment firm — Dundon Capital Partners — to pursue broader opportunities.

Dundon Capital Partners: Building a Business Empire

Founded in 2015, Dundon Capital Partners is Tom’s primary investment vehicle. The firm focuses on:

- Financial Services

- Healthcare

- Real Estate

- Sports & Entertainment

- Technology Innovations

Through Dundon Capital, he has invested in established brands and emerging trends alike, emphasizing businesses with long‑term value potential.

Examples:

- Employer Direct Healthcare — a healthcare services company

- Pacific Elm Properties — real estate investment and development

- Pickleball Central — major retail and league involvement

His investment philosophy emphasizes diversification, disciplined capital deployment, and strategic scaling.

Major Investments and Business Ventures

Tom’s business interests go far beyond finance:

Santander Consumer USA

Tom’s original venture into subprime auto lending became a billion‑dollar success story. When the company went public in 2014, it had a valuation of over $8 billion. Later, a 2017 settlement reportedly netted Dundon roughly $713 million.

Topgolf

Dundon invested early in Topgolf, which has become a leading entertainment and sports brand. After its merger with Callaway Brands in 2021, Topgolf’s value soared.

Carolina Hurricanes (NHL)

Tom purchased a majority stake in 2018 for $420 million and later became the full owner, reshaping the franchise’s competitive and business success.

Portland Trail Blazers (NBA)

In August 2025, Tom agreed to buy the Blazers for around $4 billion — one of the most significant franchise deals in modern NBA history.

Pickleball and Sports Innovation

He’s also a key investor in Pickleball Central and helped evolve professional pickleball into a nationally recognized sport.

Tom Dundon Net Worth 2026 – Breakdown & Estimates

Different financial sources estimate Tom Dundon’s net worth in various ways. While exact figures vary, most reliable estimates place his wealth in the billion‑dollar range.

| Source | Net Worth Estimate (2025 / 2026) |

|---|---|

| Forbes / Business Profiles | ~$1.5 — $1.7 billion |

| Biography Sites | ~$1.2 — $2.6 billion |

| Market Screener | ~$218 million — internal holdings (SEC data) |

Key Wealth Contributors:

- Sale and settlement from Santander Consumer USA

- Equity in Topgolf / Callaway Brands

- Ownership in Carolina Hurricanes, and soon Portland Trail Blazers

- Diverse investment portfolio via Dundon Capital Partners

Consensus: Tom Dundon’s net worth is widely considered to be in the billionaire class.

Sports Franchise Ownership

Tom’s move into sports ownership has been transformative for his public profile and asset base.

Carolina Hurricanes (NHL)

- Purchased: 2018 majority stake

- Full Owner: 2021

- Growth: Under his leadership, the Hurricanes turned themselves into perennial playoff contenders and boosted attendance.

Portland Trail Blazers (NBA)

- Agreement: August 2025 to acquire for ~$4B

- Impact: Potential franchise improvements and stability for fans.

Philanthropy and Personal Life

Tom keeps a relatively private personal life but is known for:

- A long marriage to Veruschka Dundon

- Raising five children

- Philanthropic contributions through the Dundon Family Charitable Fund, supporting education and athletics

Tom Dundon’s Wealth Strategy – What Sets Him Apart

Here’s what makes Tom Dundon’s financial journey unique:

- Diversification Across Sectors: Finance, real estate, sports, and entertainment.

- Calculated Risk‑Taking: From Santander to sports, he consistently evaluates long‑term potential.

- Hands‑On Ownership: Particularly evident in his approach to the Hurricanes and Trail Blazers.

FAQs

1. What is Tom Dundon’s current net worth?

Tom Dundon’s net worth as of 2026 is estimated between $1.2 billion and $2.6 billion, with many sources placing him near $1.5–$1.7 billion.

2. How did he make his money?

He built wealth through:

- Co‑founding Santander Consumer USA

- Strategic exits and settlements

- Investments via Dundon Capital Partners

- Sports franchise ownership

3. What teams does Tom Dundon own?

He owns the Carolina Hurricanes (NHL) and is acquiring the Portland Trail Blazers (NBA).

4. Is Tom Dundon a billionaire?

Yes — based on multiple trusted estimates, he is considered a billionaire.

5. What businesses does he invest in besides sports?

He’s involved in:

- Topgolf / Callaway Brands

- Healthcare services

- Real estate holdings

- Pickleball and sports entertainment

Conclusion

Tom Dundon’s story exemplifies how calculated risk, business acumen, and diversified investments can build lasting wealth. From humble beginnings in auto financing to becoming a billionaire sports franchise owner, his journey is a testament to modern entrepreneurship and investment strategy.

If you’re fascinated by wealth creation and business leadership, Tom Dundon’s career offers deep lessons and inspiring insights.