Real estate depreciation is one of the most valuable tax advantages available to property owners, but many investors still rely on the default approach: depreciating an entire building over 27.5 years (residential rental) or 39 years (commercial). That method is simple, but it often leaves significant cash flow on the table in the early years of ownership. This is where a cost segregation study comes in, and where many people ask the same core question: how does cost segregation work in real terms?

At a high level, cost segreation is an IRS-recognized engineering-based analysis that breaks a property’s total cost into components with different “useful lives” under MACRS depreciation rules. By reclassifying qualifying elements of a building into shorter-life categories (typically 5-year, 7-year, or 15-year property), owners can accelerate depreciation, reduce taxable income, and improve near-term cash flow, without changing the property’s economics or operations.

If you’re evaluating whether this strategy fits your situation, the best next step is often a professional screening. Cost Segregation Guys can help you evaluate eligibility, estimate potential savings, and determine whether a study is likely to produce meaningful benefits for your property profile, so you can make a decision based on numbers, not guesswork.

If you own income-producing housing, a Cost Segregation Study for Residential Rental Property can be especially impactful when timed correctly with improvements, acquisitions, or tax planning.

In this guide, we’ll walk through exactly how cost segregation works, what assets get reclassified, how bonus depreciation interacts with the study, what the process looks like, and what to expect from documentation and audit support.

What Cost Segregation Is (And What It Isn’t)

Cost segregation is a method of identifying and separating the parts of a property that qualify for faster depreciation than the building structure itself.

What it is:

- A systematic analysis of construction, acquisition, and improvement costs

- An allocation of those costs into IRS-recognized asset categories

- A depreciation strategy that front-loads deductions into earlier years

What it isn’t:

- A loophole or “aggressive trick” if completed properly

- A way to deduct more than you’re allowed overall (it changes timing, not total depreciation)

- Something based on generic percentages without documentation

The key concept is depreciation “reclassification.” Buildings are long-life properties, but many embedded components are not. When a study identifies those shorter-life components, depreciation accelerates, and that can materially improve after-tax returns.

How does Cost Segregation Work? The Core Mechanics

To understand how cost segregation works, you need to understand how the IRS treats different types of property under MACRS:

- Residential rental building: typically 27.5-year depreciation

- Nonresidential (commercial) building: typically 39-year depreciation

- Personal property (certain interior components): commonly 5-year or 7-year

- Land improvements (site work outside the building): commonly 15-year

A cost segregation study reclassifies parts of the building and site work into the appropriate shorter-life categories. The result is that a larger portion of your depreciable basis is deducted earlier—sometimes dramatically earlier.

The big picture effect

Instead of depreciating (example) $1,000,000 over 27.5 years, you might end up with something like:

- $250,000 in 5-year property

- $100,000 in 15-year property

- $650,000 remaining in 27.5-year property

You still depreciate the full basis over time; you just claim more of it sooner.

What Gets Reclassified in a Cost Segregation Study?

While every property is different, most cost segregation studies focus on two major categories beyond the building shell:

1) Short-life “personal property” (often 5- or 7-year)

Examples frequently include:

- Certain types of flooring and specialized finishes

- Dedicated electrical for equipment or specific use areas

- Specialty plumbing serving dedicated equipment

- Cabinetry and millwork in non-structural applications

- Decorative lighting and certain interior improvements

- Removable partitions and specialty build-outs

2) Land improvements (often 15-year)

Examples frequently include:

- Parking lots, sidewalks, curbs, and paving

- Landscaping and site lighting

- Fencing, signage, retaining walls

- Drainage and certain exterior utility connections

The building structure and structural components generally remain 27.5 years (residential rental) or 39 years (commercial). The study is about properly identifying what does not belong in that long-life bucket.

The Role of Bonus Depreciation (And Why Timing Matters)

Cost segregation becomes even more powerful when combined with bonus depreciation, because many short-life assets can qualify for immediate expensing (subject to current-year bonus rules). Even when bonus depreciation phases down, accelerated categories still produce larger early deductions than straight-line building depreciation.

This is one reason investors revisit the same question each year: how to segregate work when tax rules shift? The stable answer is: the study reclassifies assets. The variable part is: the percentage of those reclassified assets that can be expensed immediately via bonus depreciation in that tax year.

Timing considerations often include:

- Year of acquisition (placing the property in service)

- Year of major renovation or improvement

- Passive activity limitations and real estate professional status considerations

- Planned disposition horizon (short hold vs long hold)

A good study doesn’t just generate allocations; it supports a broader tax strategy.

If you’re still deciding whether accelerated depreciation is worth it, Cost Segregation Guys can help you compare scenarios, standard depreciation vs. a cost segregation approach, so you understand potential first-year deductions, cash-flow impact, and documentation expectations.

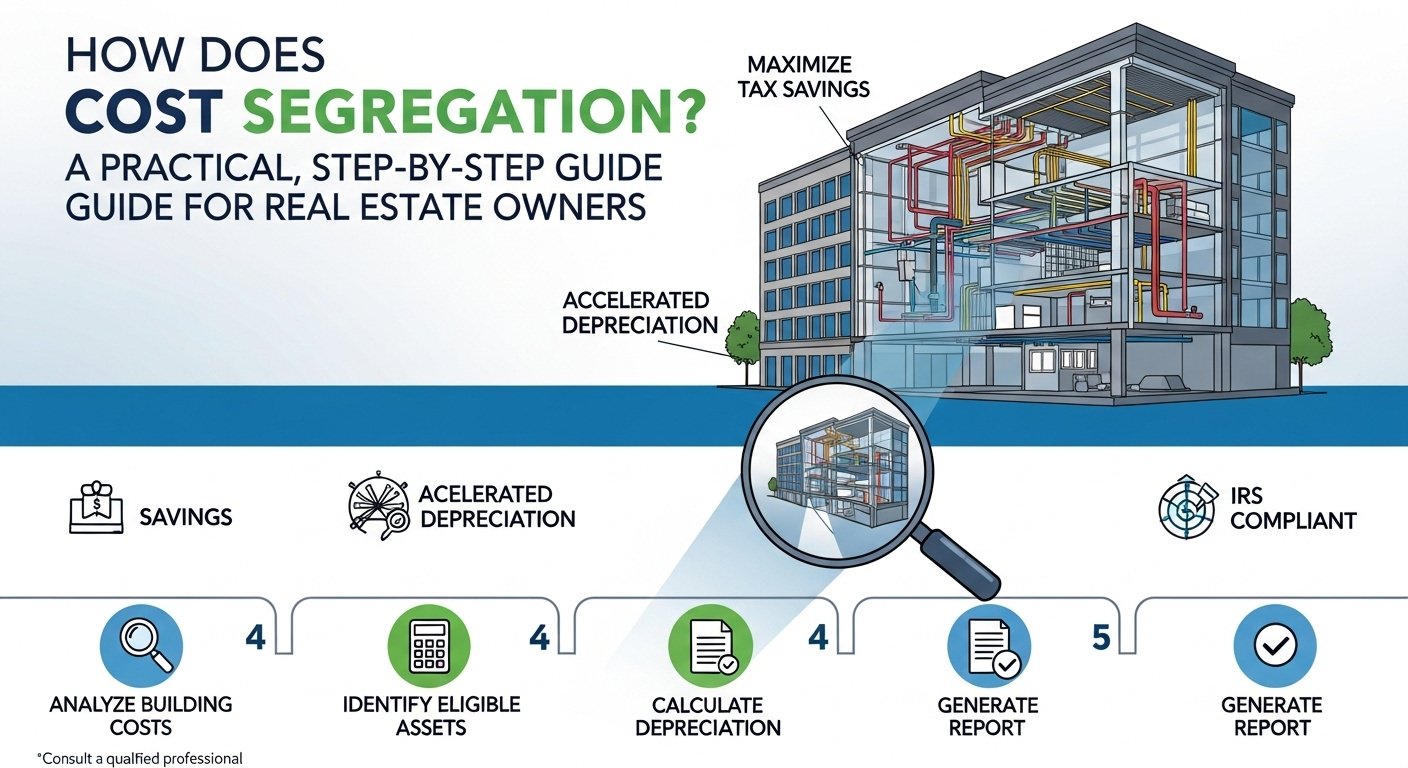

The Cost Segregation Workflow: Step-by-Step

Here’s what the process typically looks like from start to finish.

Step 1: Feasibility review and initial data collection

A provider gathers basic information such as:

- Property type, use, and placed-in-service date

- Purchase price and allocations (building vs land)

- Improvement costs and timing

- Prior depreciation schedules (if already depreciating)

This phase determines whether a study is likely to produce enough benefit to justify the effort.

Step 2: Documentation review

A thorough study relies on documents such as:

- Closing statements and purchase agreements

- Appraisals (if available)

- Construction drawings and specs

- Contractor pay apps, invoices, and cost breakdowns

- Fixed asset schedules and depreciation reports

If detailed invoices aren’t available (common in acquisitions), specialists may use accepted estimation methodologies supported by engineering analysis.

Step 3: Site visit or engineering assessment

Many high-quality studies include a site inspection (or detailed remote review when appropriate) to identify:

- Asset locations and quantities

- Quality grades and material types

- Specialized systems and build-outs

- Site improvements and exterior scope

The goal is to ground the classification in real property features, not generic assumptions.

Step 4: Engineering-based cost allocation

This is where the “segregation” happens:

- Components are identified

- Costs are assigned using direct costs or engineering estimates

- Assets are categorized by MACRS life (5/7/15/27.5/39-year)

- A defensible methodology is documented

Step 5: Deliverables and tax filing support

The final package generally includes:

- Asset-by-asset cost breakdown

- Depreciation schedules

- Methodology narrative and supporting exhibits

- Guidance for the CPA to implement on the return

At this point, you can see clearly how cost segregation works in practice: it produces the reclassified asset schedule that drives accelerated depreciation.

How a Study Works for Different Property Types

Residential rental property (27.5-year building)

Multifamily, single-family rentals, and portfolios often benefit from:

- Site improvements (parking, walkways, landscaping)

- Common area build-outs (clubhouse, fitness areas, leasing offices)

- Interior unit components that qualify as shorter-life property

A Cost Segregation Study for Residential Rental Property is often most beneficial when done shortly after acquisition or after substantial improvements, because the earlier deductions can help offset near-term cash taxes.

Commercial property (39-year building)

Office, retail, industrial, and hospitality often see:

- Specialized electrical and plumbing

- Tenant improvements and build-outs

- Significant land improvements and exterior scope

- Equipment-driven layouts that create more 5- and 15-year property

Renovations and improvements

Even if you’ve owned a building for years, a new renovation can create a new pool of depreciable assets, often with meaningful 5- and 15-year components. In many cases, the improvement costs are where the strongest short-life allocations are found.

What About Cost Segregation on a Primary Residence?

Cost segregation is generally associated with investment or business property where depreciation is permitted. Many homeowners ask about Cost Segregation on Primary Residence because they’ve heard the term and want to explore it.

In most standard situations, a primary residence is not depreciable because it is personal-use property. However, there are scenarios where part of a residence may be tied to business or income production (for example, certain rental use or other qualified uses), and depreciation rules can become more complex. The correct approach is to coordinate closely with a qualified tax professional to determine whether any portion of the property is eligible for depreciation and whether a cost segregation approach is appropriate under the facts and circumstances.

The key takeaway is that eligibility depends on how the property is used and reported for tax purposes, not simply what the property is.

Implementation Details Your CPA Will Care About

A cost segregation study affects the depreciation schedules on your tax return. Implementation often includes:

- Updating fixed asset schedules with the reclassified assets

- Adjusting depreciation methods (MACRS, convention rules, and placed-in-service dates)

- Considering a change in accounting method when doing a study on a property already being depreciated

If you’re doing a study retroactively (for a property already in service), your CPA may use Form 3115 (Change in Accounting Method) to claim the catch-up depreciation you would have taken in prior years. This is one of the most valuable features for owners who “missed” cost segregation at acquisition.

This is another practical point in understanding how cost segregation works: it’s not only for brand-new purchases. It can be applied later, and the tax code provides mechanisms to correct depreciation timing.

Audit Readiness: What Makes a Study Defensible

Not all studies are equal. A defensible study generally includes:

- Clear methodology grounded in engineering principles

- Specific asset descriptions and classifications

- Support for cost estimation methods

- Documentation tying conclusions back to property details

- A report format that a CPA and IRS reviewer can follow

The IRS has long recognized cost segregation when performed properly. The difference between a robust study and a thin one usually comes down to documentation quality and methodological rigor, not just the size of the deduction.

Common Questions and Misconceptions

“Does cost segregation create extra depreciation?”

No. It changes the timing of depreciation by moving qualifying assets into shorter lives.

“Is it only for large properties?”

No. While larger properties can yield larger absolute savings, smaller properties can still benefit depending on basis, improvements, and tax position.

“Will I pay it all back later?”

Acceleration can increase depreciation recapture at sale, but outcomes depend on holding period, tax rates, and exchange planning (such as 1031 strategies, when applicable). Many investors value the time value of money and reinvest the tax savings.

“Is a study worth it if I don’t have taxable income?”

It depends. If losses are suspended due to passive activity rules, the deductions may still be valuable in future years. Planning around material participation and portfolio strategy matters.

A Simple Example to Illustrate the “How”

Imagine an investor buys a residential rental building and allocates $2,000,000 to the building (excluding land). Without cost segregation, that basis is depreciated over 27.5 years.

With a cost segregation study, the engineering analysis identifies:

- $500,000 in 5-year personal property

- $250,000 in 15-year land improvements

- $1,250,000 remaining in 27.5-year building property

Now the investor has a much larger first-year depreciation profile, especially if bonus depreciation is available for qualifying categories in that tax year.

Practical Signals You May Be a Good Candidate

Cost segregation tends to be more compelling when:

- You acquired, built, or renovated property recently

- The property has substantial site work or specialized build-outs

- You anticipate high taxable income this year or next

- You want to improve cash flow for reinvestment

- You have multiple properties and want standardized asset schedules

Even if you’re unsure, a feasibility review can usually provide clarity quickly.

Conclusion

So, how does cost segregation work? It works by identifying and reclassifying the components of a building and its improvements into shorter depreciation lives under MACRS, typically 5-, 7-, and 15-year property, so you can accelerate depreciation deductions and reduce taxable income earlier in the ownership cycle. Done correctly, it is a documentation-driven, engineering-supported process that aligns with IRS rules and integrates directly into your CPA’s depreciation schedules.

If you’re evaluating whether a study fits your property and tax situation, Cost Segregation Guys can help you move from general interest to clear decision-making by estimating potential benefits and outlining what a study would look like for your asset type.